THE tech sector powered global equity markets higher in the first half of 2024, led by an elite group of mega-cap stocks leveraged to the advancement in artificial intelligence (AI). These leaders, dubbed the “Magnificent 7” in 2023, retained their lustre through the first half of 2024, as the AI momentum continued unabated.

Then came a speed bump in July, which stirred consternation for some tech investors. What is next for tech? Can the sector’s strong performance continue?

We believe it can and see the summer setback as temporary. We do observe greater differentiation across technology stocks, even among the Magnificent 7, as the market attempts to assign “winners” and “losers” in the race for AI development, enablement and adoption.

Our recent week-long tour and conversations with the leaders of 29 public and private technology companies in San Francisco and Silicon Valley confirmed our underlying thesis: AI is here to stay, and we’re only at the tip of the iceberg in terms of investment opportunity.

Today, the monetisation of AI resides primarily in the build-out of AI “factories”. Hyperscalers, private enterprises and government entities are pouring hundreds of billions of dollars into the construction of these data centres, namely by spending on clusters of graphics processing units (GPUs) in the race to support ever-larger AI models. GPUs are the type of semiconductor critical for generative AI training and inference workflows.

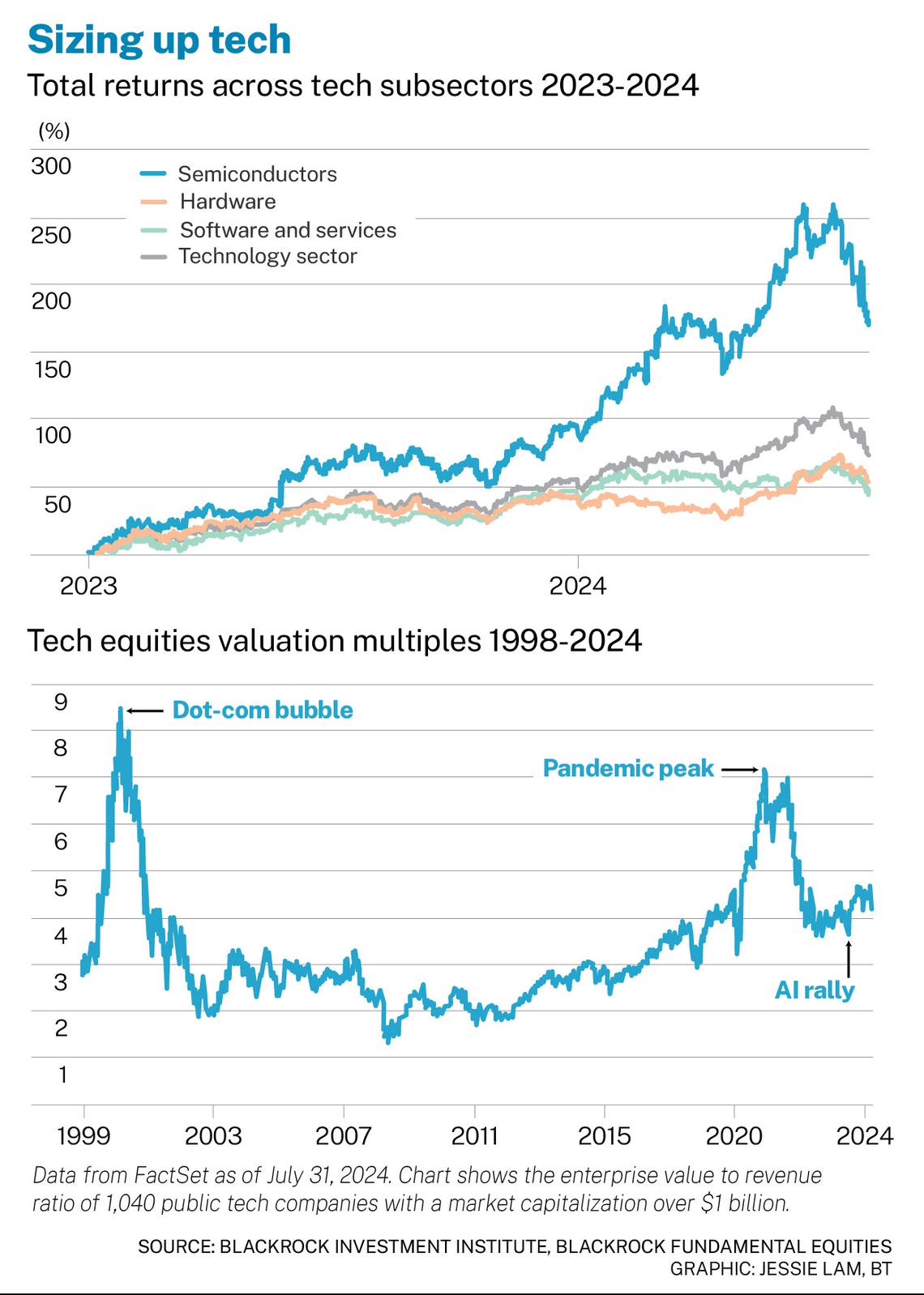

Meanwhile, use cases and real-world applications of AI are in much earlier stages, and the significant impact from AI products is not expected until 2025. This is leading to cautious spending on software development, while software customers are likewise delaying purchases in anticipation of AI advancements. The first of the two charts below illustrates the divergence in returns across technology subsectors.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

According to a Morgan Stanley survey of chief information officers (CIOs), half of AI spending is drawn from existing IT budgets, suggesting AI investment is supplanting other categories of IT spending. Hyperscalers offering cloud services are consuming a large portion of enterprise IT budgets.

This type of bifurcation underscores the heavy influence that AI is having across the economy and markets, with its evolution driving the investment opportunity set. AI momentum reinforces our outlook for future returns, and the differentiation we are seeing does nothing to dim that. Rather, it highlights the need for individual stock research and selection to capitalise on the opportunities as the AI evolution advances.

A market without precedent

The technology sector’s strong performance last year and into 2024 has prompted questions of whether technology stocks are overvalued. Some have made comparisons to the dot-com bubble of the late 1990s, and the pandemic-era market, where the “digitisation of everything” led to heavy IT investment, while historically low interest rates supercharged tech stocks. Both ended in busts.

We do not think today’s market is akin to either of these periods. The second of the two charts above illustrates the valuation difference relative to the dot-com bubble and pandemic peak. Much of the scepticism about tech’s ability to power on is based on trailing sales and earnings estimates. Yet many tech stocks are cheaper today than they were before the rally began in 2023, when factoring in revisions to forward-looking earnings estimates.

As at July, the average 2024 earnings growth forecast for the technology sector stood at 20 per cent – a notable increase from early-year estimates. Profit margins in the sector have also expanded.

No comparison

We believe earnings growth can remain healthy for the technology sector broadly, fuelled by the build- out of AI and a commitment to cost prudence on the part of tech firms.

But we evaluate company fundamentals on an individual basis, with an emphasis on owning the right names at the right price. Our team of technology-focused, fundamentals-based stock researchers and selectors is looking to identify the next areas of opportunity while also assessing which business models may be at risk as AI becomes increasingly sophisticated.

In all, we believe the rapid evolution of AI and all its ramifications makes investing in this space very much an active pursuit. Volatility such as that seen of late, while always unsettling, is not unexpected and could present buying opportunities in this exciting and, we believe, enduring theme.

Tony Kim is lead portfolio manager and Reid Menge is portfolio manager with the global technology team, BlackRock

Copyright for syndicated content belongs to the linked Source link