Comprehensive Guide to the True Costs of Relocating from the U.S. to Canada

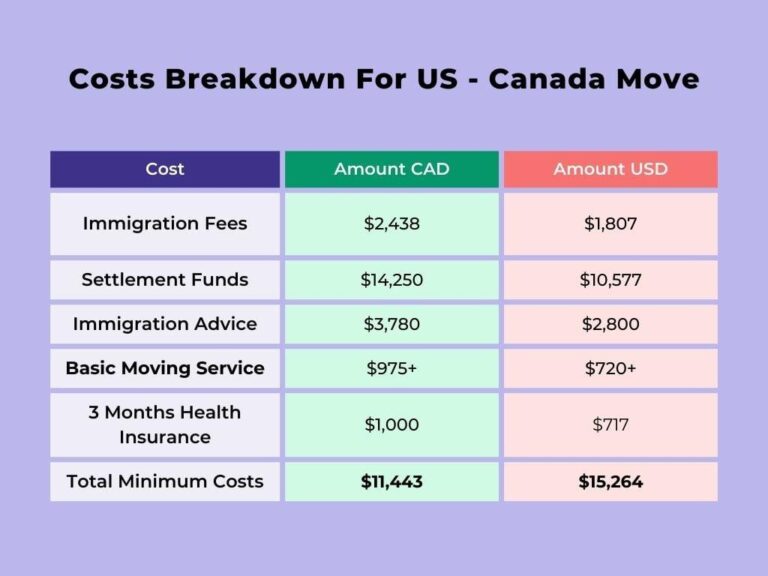

For many Americans, moving to Canada represents an exciting opportunity for career growth, lifestyle enhancement, or family reunification. Yet, the financial implications of such a transition are often underestimated. This guide delves into the multifaceted expenses involved in relocating across the border, covering everything from immigration fees to housing market challenges and everyday living costs. Whether you’re moving for work, education, or personal reasons, understanding these costs will empower you to plan your move with confidence and avoid unexpected financial hurdles.

Unseen Moving Expenses: Beyond Shipping and Transportation

When preparing your budget for a move from the United States to Canada, it’s crucial to look beyond the obvious costs like airfare and freight charges. Numerous hidden fees can significantly inflate your moving expenses. For example, customs brokerage fees are often required to manage the paperwork and duties associated with importing household goods. Additionally, if you plan to bring a vehicle, you must account for import taxes, mandatory inspections, and possible modifications to meet Canadian standards.

Other frequently overlooked costs include temporary accommodation if your belongings arrive after you do, currency exchange losses during payment transactions, and the expenses related to setting up new utilities and communication services. Establishing yourself in a new country also involves practical steps such as obtaining a Canadian mobile phone plan, arranging internet service, and transferring medical records, all of which carry their own costs and logistical considerations.

- Customs brokerage charges: Fees for handling import documentation and duties.

- Vehicle importation expenses: Taxes, inspections, and necessary modifications.

- Interim housing costs: Accommodation if your possessions arrive later.

- Utility and communication setup: Internet, phone, and other essential services.

- Currency exchange fluctuations: Potential financial impact from conversion rates.

Immigration and Legal Costs: Navigating Visa Applications and Professional Assistance

Understanding the financial requirements of Canada’s immigration process is vital for any prospective mover. Visa application fees vary depending on the type of permit sought, with costs ranging from approximately CAD 150 to CAD 1,040 per individual. Beyond government fees, many applicants incur additional expenses such as legal consultation fees, translation of official documents, medical examinations, and biometric data collection.

Engaging an immigration lawyer or consultant can streamline the process but typically costs between CAD 2,000 and CAD 5,000, depending on the complexity of your case. It’s important to budget for these services as well as for any unexpected charges that may arise during the application process.

- Government application fees: Set by Immigration, Refugees and Citizenship Canada (IRCC).

- Legal and consultancy fees: Professional assistance for paperwork and guidance.

- Document-related costs: Translations, medical exams, and police clearances.

- Biometric processing fees: Usually around CAD 85 per applicant.

| Expense | Typical Cost (CAD) |

|---|---|

| Permanent Residency Application | 1,040 |

| Work Permit Application | 155 |

| Legal Services | 2,000 – 5,000 |

| Biometric Fee | 85 |

| Document Translation | 150 – 500 |

Understanding Canada’s Housing Market: What Newcomers Should Anticipate

The Canadian real estate landscape has experienced notable volatility, especially in urban centers like Toronto, Vancouver, and Montreal. Compared to many U.S. cities, entry costs for homebuyers in these markets tend to be higher, with fierce competition and limited housing supply driving prices upward. Unlike some American suburbs where new developments may offer affordable alternatives, Canadian metropolitan areas often present fewer options, leading to bidding wars and premium pricing on desirable properties.

In addition to the purchase price, newcomers should prepare for several ancillary costs unique to the Canadian housing market:

- Property Transfer Taxes: These vary by province and can add thousands to upfront expenses.

- Legal Fees: Required for property transactions, typically ranging from $900 to $2,500 CAD.

- Home Inspections: Essential to identify potential issues, costing between $300 and $700 CAD.

- Currency Exchange Impact: Fluctuating rates can affect your purchasing power at closing.

| Cost Category | Estimated Price Range (CAD) |

|---|---|

| Down Payment and Deposit | 40,000 – 200,000+ |

| Property Transfer Tax | 2,000 – 15,000 |

| Legal Fees | 900 – 2,500 |

| Home Inspection | 300 – 700 |

Unanticipated Expenses and Smart Budgeting Strategies for a Seamless Move

Relocating internationally involves more than just the visible costs of flights and housing deposits. Many hidden expenses can surprise newcomers, such as health insurance premiums during the waiting period before provincial coverage activates, fluctuating currency exchange rates, and unexpected transportation fees. For example, in provinces like Ontario and British Columbia, new residents may face a three-month waiting period before qualifying for public health insurance, necessitating private coverage in the interim.

To mitigate financial surprises, consider these practical budgeting tips:

- Allocate funds for all mandatory immigration fees and anticipate processing delays.

- Account for customs duties and potential storage fees when shipping belongings internationally.

- Keep cash reserves for immediate needs such as groceries, transportation, and utility deposits upon arrival.

- Include a contingency fund of 10-15% in your overall moving budget to cover unforeseen costs.

| Expense Type | Estimated Cost (USD) | Additional Notes |

|---|---|---|

| Visa and Immigration Fees | 200 – 1,500 | Varies by visa category and complexity |

| Health Insurance | 150 – 400/month | Until provincial coverage begins |

| Moving and Shipping | 2,000 – 5,000 | Depends on volume and distance |

| Initial Living Expenses | 1,000 – 3,000 | Includes deposits and essentials |

Final Thoughts: Preparing Financially for Your Canadian Relocation

Embarking on a move from the United States to Canada involves a diverse array of costs that extend well beyond the initial travel and housing expenses. From immigration fees and legal services to hidden charges related to shipping and settling in, the financial landscape can be complex. Staying informed about current regulations, market conditions, and potential pitfalls is essential for a successful transition. By carefully planning and budgeting for all aspects of the move, including unexpected expenses, you can ensure a smoother, less stressful relocation experience as you start your new chapter in Canada.