Exploring Urban Affordability: The Most and Least Expensive U.S. Cities in 2024

Key Factors Driving High Living Costs in America’s Priciest Cities

In today’s fluctuating economic environment, pinpointing where your money stretches the furthest is essential. Among the top contributors to elevated living expenses in major metropolitan areas are housing and transportation. Limited housing supply combined with surging demand and escalating construction costs have propelled median home prices to unprecedented heights, particularly in economic hubs with thriving job markets. For instance, cities like San Francisco and New York continue to top the charts, where monthly housing payments for both renters and homeowners often exceed twice the national average. Additionally, increased property taxes and stringent zoning regulations further restrict affordable housing availability.

Transportation costs also weigh heavily on residents in these expensive urban centers. Many commuters face extended travel durations, elevated fuel prices, and the necessity of owning multiple vehicles due to insufficient public transit infrastructure. In car-dependent cities, expenses such as parking fees, insurance premiums, and vehicle upkeep significantly inflate monthly budgets. Conversely, cities with comprehensive and efficient public transportation systems, while still costly, tend to alleviate some of these financial pressures.

| City | Average Monthly Rent | Transportation Expenses | Median Home Price |

|---|---|---|---|

| San Francisco, CA | $3,400 | $300 | $1.4M |

| New York, NY | $3,200 | $250 | $950K |

| Boston, MA | $2,800 | $270 | $720K |

- Housing: The largest contributor to monthly expenses, driven by scarce availability and high demand.

- Transportation: Encompasses costs related to vehicle ownership, public transit fares, and parking, often underestimated.

- Economic Growth: Rapid expansion in sectors like technology and finance intensifies demand in these urban markets.

Affordable Urban Living: Cities That Balance Cost and Quality of Life

Contrasting the high-cost metros, several U.S. cities offer residents affordable living without compromising access to vital amenities. Places such as Tulsa, Oklahoma, and Wichita, Kansas, exemplify how lower housing prices and manageable living expenses coexist with vibrant cultural offerings and essential services. Residents benefit from thriving arts scenes, accessible parks, reliable public transit, and diverse culinary options-all at a fraction of the cost found in pricier cities.

These affordable cities also provide:

- Comprehensive healthcare services within convenient reach

- Quality educational institutions, including community colleges and universities

- Expanding employment opportunities in sectors like manufacturing, technology, and services

- Community engagement through local events and recreational programs fostering social cohesion

| City | Average Rent (1-Bedroom) | Monthly Utilities | Public Transit Accessibility Score |

|---|---|---|---|

| Tulsa, OK | $750 | $120 | 68 |

| Wichita, KS | $700 | $110 | 55 |

| Fayetteville, AR | $780 | $115 | 60 |

The Interplay Between Employment Markets, Income, and Affordability

The affordability of urban areas is closely linked to the strength and diversity of local job markets and the income levels they support. Cities with robust economies anchored by high-paying industries such as technology, finance, and healthcare attract skilled professionals, which in turn drives up demand for housing and services. This economic vitality, while fostering innovation and growth, often results in elevated living costs, positioning these cities among the nation’s most expensive. On the other hand, cities with economies centered on lower-wage industries tend to offer more affordable living but may struggle to attract and retain a skilled workforce.

Recognizing this dynamic is vital for both policymakers and individuals considering relocation. The table below highlights the correlation between median household income and average rental costs in select cities, illustrating how income disparities influence housing affordability:

| City | Median Household Income | Average Rent (1-Bedroom) | Rent-to-Income Ratio |

|---|---|---|---|

| San Francisco, CA | $112,000 | $3,500 | 37% |

| Houston, TX | $65,000 | $1,200 | 22% |

| New York, NY | $85,000 | $2,900 | 41% |

| Buffalo, NY | $50,000 | $900 | 22% |

- High-income urban centers often experience rent-to-income ratios above 35%, indicating significant affordability challenges.

- Lower-income cities generally maintain ratios below 25%, reflecting more accessible housing costs despite fewer amenities.

Strategies for Managing Expenses in Costly Metropolitan Areas

Residing in a city with a steep cost of living doesn’t have to overwhelm your finances if you adopt mindful spending habits. Utilizing public transit options such as subways, buses, or bike-sharing programs can drastically reduce commuting expenses compared to car ownership. When dining, exploring food trucks, farmers’ markets, and happy hour specials can help curb restaurant bills. Additionally, leveraging mobile apps that highlight discounts on groceries, secondhand items, and entertainment can stretch your budget further. Engaging in community events and enjoying public parks also offer enriching experiences without extra costs.

Housing typically consumes the largest share of monthly income in expensive cities. To mitigate this, consider shared living arrangements, negotiate lease terms, or explore neighborhoods just outside the urban core where rents tend to be lower but amenities remain accessible. Keeping a detailed budget and prioritizing essential expenses while trimming discretionary spending-such as subscription services or frequent ride-hailing-can also improve financial stability. The table below summarizes practical cost-saving approaches:

| Expense Category | Money-Saving Tips |

|---|---|

| Transportation | Opt for public transit, carpooling, or bike-sharing programs |

| Housing | Share housing, consider suburban areas, negotiate rent |

| Food | Shop at local markets, prepare meals at home, seek discounts |

| Entertainment | Attend free community events, utilize library resources |

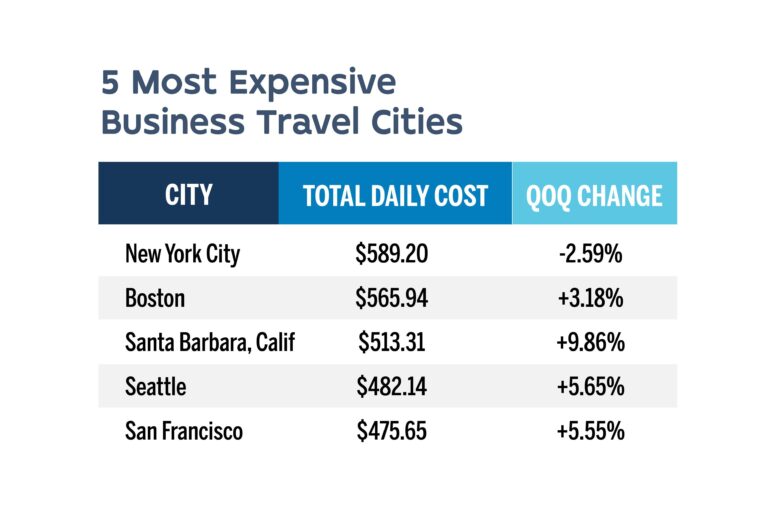

Final Thoughts on Navigating Urban Cost Variations

Grasping the diverse cost structures across U.S. cities is indispensable for individuals and businesses contemplating relocation, investment, or expansion. As demonstrated by the latest Business Insider evaluation of the 15 most and least expensive cities, factors such as housing affordability, transportation expenses, and everyday costs continue to shape the economic fabric of urban life. Staying informed about these evolving trends empowers residents and decision-makers to better manage financial challenges and capitalize on opportunities within today’s dynamic metropolitan landscapes.